As COVID-19 grips the globe at an ever rising pace, day to day life in majority of the world has come to a virtual standstill. At this point, it has become very clear that the economic fallout from this virus breakout will be huge and most likely unprecedented.

Discussions around government preparedness, efficacy of the global healthcare system and the systemic risk to globalization are currently being widely debated. The objective of this piece is to analyze what the economic fallout from this global health emergency could look like and whether the world has historically handled anything of a similar magnitude. It needs to be emphasized that this pandemic is still a developing story and the uncertainties involved make any analysis contingent upon various assumptions and conjectures.

How extreme could be the economic fallout?

There is a famous concept in behavioral finance known as a Black Swan Event. It focuses on the extreme impact of rare and unpredictable outlier events — and the human tendency to find simplistic explanations for these events, retrospectively. At this point, the global COVID-19 could be categorized as a Black Swan event that has sent some major shock-waves across the global economic landscape. By nature, it is widely different from an ordinary recession where businesses deteriorate as conditions worsen. With little to no warning, this outbreak has led to catastrophic execution of businesses across different industries. Millions across the developed world have lost their livelihood in a matter of days.

This unprecedented pace and sheer magnitude of damage (already) is something which really stands out from any previous global economic meltdown.

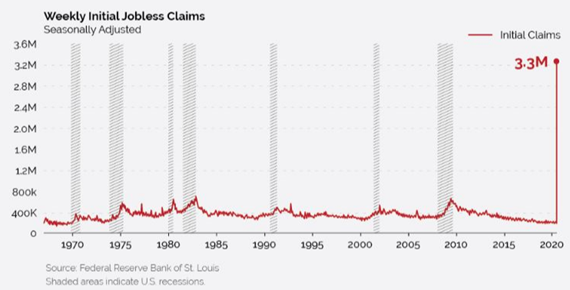

US Weekly Jobless claims (number of people filing claims for unemployment insurance) print last week is a case in point, which recorded an all-time high print of 3.3 million. From a statistical point of view, it is a 30-sigma (standard-deviation) event, which somewhat portrays the true extremity of this event. For reference, observations beyond 3-sigma are generally considered a rarity.

Multi-dimensional impact

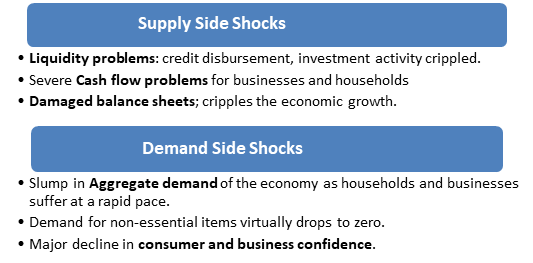

Covid-19 has led to a rapid destruction of the global supply chain. It has hammered International trade and degraded economic sentiment at an alarming pace. Global financial-market gyrations and asset value destruction also means that the households face extreme negative “Wealth effect”, at a time when there are millions of layoffs worldwide.

A remarkable difference from any historical economic slump is the truly unprecedented scale of ‘Real Economy Freeze’. Never in the post WW-II era have so many nations and businesses in the world have been forced to shut simultaneously. This makes policy making all the more challenging. Till the time Covid-19 spread curve is not peaking out and being controlled, economic activity faces an all-out shut-down because of various government containment measures. Needless to say, many industries and Multinationals won’t survive this without government support and bailouts.

How have the Governments and Central Banks responded?

The world was already operating in a low interest rate (at or near zero in many advanced economies) and high-debt regime. It limits the government/ Central bank response to the pandemic in a major fashion, as the Central Bank ammunition is fairly limited to say the least. But, at the same time, this is what is famously referred to as the, ‘Whatever it takes’ moment for the policy-makers. Arguments for fiscal prudence or debt mitigation go for a toss in times like these.

It is also important to point out the limitations in monetary policy action and transmission here. Monetary stimulus in the form of reduced interest rates has an inherent lag and its effects aren’t fully passed on to the beneficiaries in a span of less than a few quarters. But, time is of ultimate essence here. Businesses and people need to be rescued, and rescued now. Most impacted countries have already resorted to various forms of fiscal stimulus and helicopter- money measures. It’s fair to assume that we will see much more of these in the forthcoming months.

What could the global macro-economic recovery look like?

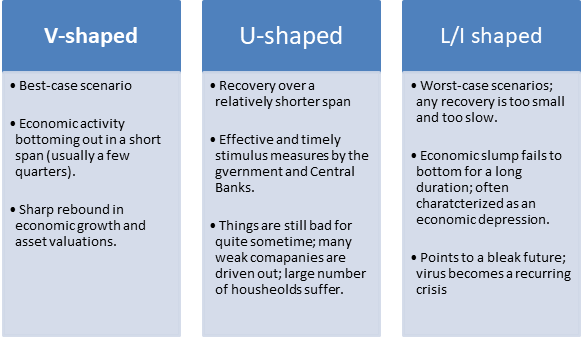

‘Recovery’ is defined as to how the economic growth, businesses and asset valuations normalize over time after the economic lull. Theoretically, it can take a few different forms:

It is important to point out that before the virus outbreak turned the global economy upside down, the world had already moved into a low growth and a slowdown phase and many parts of the world were spiraling towards a possible recession.

This makes a V- shaped recovery trajectory difficult to achieve by nature. Trillions of dollars of helicopter money and fiscal support may translate into asset valuation recovery before the freeze in the Real Economy is mitigated. There is thus, some merit to the argument that the world may be headed towards a more prolonged stagnation than it witnessed towards the end of the last business cycle in 2007-08. Thus, a U-shaped recovery will still be contingent upon a situation where the Covid-19 outbreak is a non-recurring phenomenon and there is a swift and sustained global coordinated response to the pandemic.

Less globalized/ Protectionist Era ahead?

The Covid-19 episode has exposed some major fault-lines in the interconnected world economy. It is very obvious at this point that this very interconnectedness has bolstered the spread of the disease. The deep inter-dependence reflected in the global supply chains has in-fact created a bigger ripple effect that has already sent the world into a recession (enough evidence at this point) and quite possibly, a longstanding depression.

For a good part of the last two years, China and U.S. were involved in a trade spat and many reigning ideologies in the world were rooting for various protectionist measures. It is not hard to imagine a scenario where this outbreak will only worsen things and bolster a wave of anti-globalization rhetoric across various parts of the world. This, if happens, will surely prolong the economic slump and the recovery will take a lot longer.

The lesson from this pandemic is not that globalization is bad or has failed. More trade spats, ‘Beggar-thy-neighbor’ policies and protectionist measures could be detrimental for the macroeconomic recovery. They could shatter the idea of an open and dynamic international marketplace, something that the world would desperately need to propel itself into a higher growth trajectory in the post-Covid-19 era. Governments worldwide will also need to resort to never-before seen quantum of economic stimulus to get out of this herculean challenge. As of now, the Covid-19 grip is tightening in Europe and US with each passing day and the rest of the world has severely ill-equipped health infrastructure to face a similar challenge. This suggests that things may get far worse before they get any better. The economic slump is expected to deepen further going into the next quarter and it may not be for a while before the real recovery begins the much awaited recovery.

Disclaimer

Opinions expressed in this blog belong solely to the individual authors and do not necessarily represent the opinion of Futures First Academy, its management and other group and associated companies. These opinions do not represent professional advice. Any action you take upon the information on this website is strictly at your own risk, and we will not be liable for any losses or damages in connection with the use of our website.