Once upon a time, there was bitcoin.

And then, there wasn’t any. At least not as much.

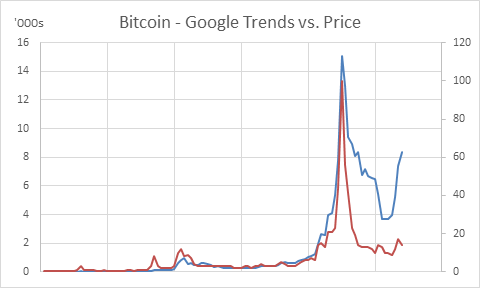

We’re not talking about the physical presence, or rather, digital presence of the cryptocurrency bitcoin. We’re talking about its mention in the popular media that has been waning for at least a year. As a quick revelation, the following chart pairs up bitcoin prices (in USD) with Google search trends for the keyword “bitcoin”. Red line represents Google search trends (left-axis) and blue line represents bitcoin price in USD (right-axis).

It fits nicely. The correlation is also very high at 85% since 2010. In fact, bitcoin was so popular in 2017 (the uphill ride in the above chart) that someone not knowing about it risked being labelled as unaware and ignorant. Was somebody deliberately trying to popularize the term “bitcoin”? I am sure many were. But, we can’t overlook the contribution of the masses in making it an everyday term. Such is the power of social media.

Now, imagine what Facebook, being a social media giant, can do with Libra – its own digital currency. So, what exactly is Libra and how is it different? This first blog is the touch of the surface. We will cover what it is. In future blog posts, we will cover what it is not.

Basics

Libra is a global digital currency, a GDC, backed by several other companies and organizations. This group, including Facebook, is called the Libra Association’s Founding Members. Eventually, the Libra Association will include other entities meeting the eligibility. If you visit the home page of the website, you’d quickly note several claims made to justify the need for a digital currency. Below is a quick look at those claims: –

1. 1.7 billion people around the world do not have a bank account; the so-called unbanked,

2. Those who have access, i.e. the banked, find cross-border payments to be slow (typical delay = 3-5 days),

3. The banked also find it costly (cost = ~7%) to send money internationally,

4. 85% of all global transactions are in cash (difficult to move, easy to steal),

5. The unbanked pay $4 per month more for access to their cash,

6. Digital financial services (such as Libra) have the potential to add $3.7 trillion to developing economics, create 95 million new jobs, reduce extreme poverty by 22% etc.

That last sentence looks like being made by a political party before election.

However, they are not simply throwing numbers. They have research to back it up. Here’s what they are referring to when they quote above data: –

Libra is supposed to be a fast, safe, stable and scalable global currency that can be accessed by anyone “with an entry-level smartphone and data connectivity.”

There are 3 important aspects of Libra: – The Libra Reserve, the Libra Blockchain, and the Libra Association. The Libra Reserve, in simple words, backs the value of each Libra unlike a cryptocurrency that has nothing similar. The purpose of the reserve is to keep the monetary value of Libra stable. In short, it seems to offer a mid-path between the physical currencies that we use and cryptocurrencies. How successful Libra will be is anyone’s guess but what is certain to follow is a lot of discussion and memes.

So, will Facebook LIBRAte between being a cryptocurrency and a physical currency in digital form? Or, will it liberate all of us from the clutches of banks and financial institutions? What do you think? Write to us on support@futuresfirstacademy.com with the subject line “Libra”.