The US corn market is one of the biggest markets for any single agricultural commodity. Like any other developed and mature market of the modern world, both the derivatives and the cash/spot market govern the dynamics here. A number of participants from commercials and farmers to speculators and arbitragers regularly uses futures contracts, a type of derivative. The cash/spot market, on the other hand, majorly constitutes farmers and commercials as their participants. The difference between cash/ spot prices and futures prices is termed as “basis”. The cash and futures market may sometimes diverge in the given life span of a futures contract but ideally, by the virtue of futures’ definition, they must converge at or near the expiry of the futures contract. Here, a question arises. Which of the two markets govern the other to cause such convergence? The answer is not that straightforward. We will consider, in this article, the dynamics of the US corn market for the ongoing season to get some sense of this debatable topic.

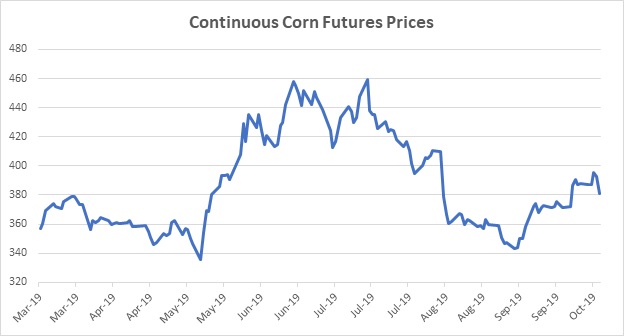

This year, since the early planting season in Apr-May’19, US corn market has indeed been on a roller coaster ride. The main uncertainty in the initial phase was around the size of the crop that could survive this year’s adverse weather for successful plantation. The clouds of uncertainty made it difficult not only for the speculators to speculate but also for the government agencies to estimate the crop size. Positioning of various funds has gone from almost record short to record long, and with surprises in data releases, these funds took no time to reverse their position. With the harvest kicking off in Sep-Oct’19, it is very shocking that the uncertainty about the size of the crop continues to linger. Amid this uncertainty, we believe that corn prices have reasons to hover in a range. Let us look at what happened to corn prices and how the uncertainty evolved and continues to startle even the seasoned market participants as this year’s crop season progressed. Specifically, we look at the reports released on 21 Apr (crop progress), 28 Jun (acreage and quarterly stocks), 12 Aug (wasde), 30 Sep (quarterly stocks) and 10 Oct (wasde).

Background of the crop cycle for corn

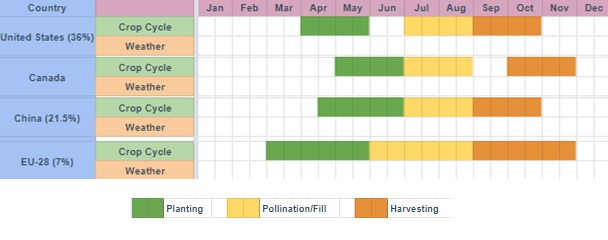

Before getting into additional details of the ongoing crop season, let us have a look at what a crop cycle for corn comprises. The crop cycle consists of three major phases: – planting, growing (pollination/filling), and harvesting. For each country, there is a unique crop cycle as is clear from the following image.

As we move ahead in the season through the different phases, various data releases by agencies such as the USDA (United States Department of Agriculture) provide estimates of the area of the total crop to be planted, total planted area to be harvested, total production, and yield (produce per unit of the planted area). Additionally, USDA also provides the demand estimates such as total exports and domestic usage etc. These estimates, when released, start playing a major role in shaping the market dynamics for a given crop season.

Ongoing crop season started with delayed planting

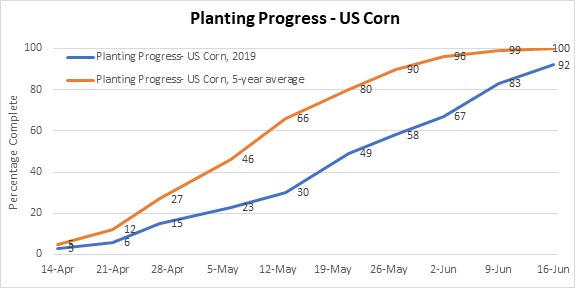

Over the last 10 years, the corn planting would start picking up pace typically around mid-April and is almost complete by the end of May. However, this year, excessive rains and snow across some states significantly delayed the corn-planting season. As per the crop progress report of 22 April 2019, released by National Agricultural Statistics Service (NASS) of the USDA, the corn planted in 18 states as on 21 April 2019 was 6% compared to 5-year average of 12%.

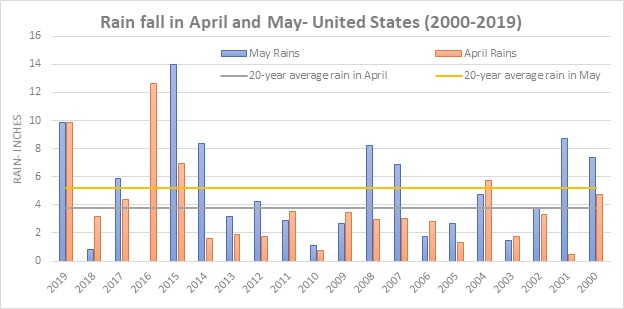

As the season progressed, the rains continued to pour much higher than normal resulting in a rainfall that was around 200% higher than the 20-year average in April and around 80% higher than the 20-year average in May (see the chart below). The cash market in US started getting pessimistic about the upcoming crop size and the basis started to widen in the early phases of the crop cycle itself.

All of this culminated in a single but significant question that is how destructive are the consequences of delayed planting for corn? Of crucial importance to farmers is the crop yield and planting date is one of the numerous factors that affect the yield. In fact, historical data suggests that the relationship between planting date and crop yield is not so clear. However, delayed planting does reduce the yield potential for that particular year’s produce.

Better than expected acreage and yields

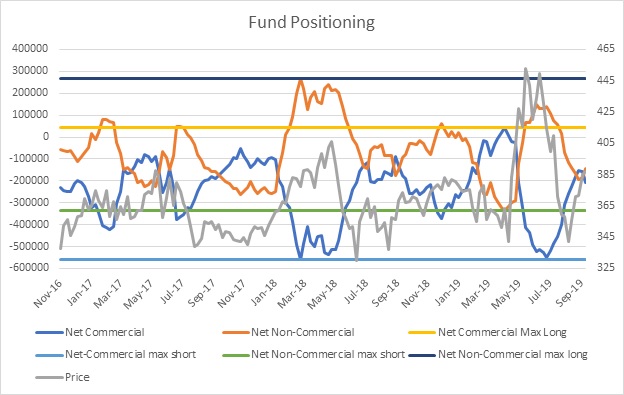

In addition to the continued apprehensions regarding the crop yield, there were doubts about the acreage loss i.e. the area that will not be planted for a given crop season. Funds, betting on the price movement of corn, had been optimistic. In the early May, as per the Commitment of Traders report, released by the US CFTC (Commodity Futures Trading Commission), the net non-commercial positions were almost record short reflecting the bets for lower corn prices. However, the adverse weather conditions, reduced yield potential and concerns of acreage loss forced the funds to reverse their position. As a result, in less than a month, starting mid-May, corn prices saw a rally from around $3.35$ to $4.65 per bushel until the release of the quarterly Grain Stocks report and the Acreage report, released by NASS (National Agricultural Statistics Service) of the USDA on 28 June 2019.

Before the release of these reports, there was a consensus for a downward revision in corn acreage but as per the quarterly Grain Stocks report, there was an increase in the acreage by 3% compared to 2018 at 91.7 million acres. Amid discussions regarding USDA’s decision to resurvey the acreage data, another astonishing release came from the WASDE report on 12August 2019. As per this WASDE (World Agricultural Supply and Demand Estimates) report, released by the USDA, the yield was better than expected at 169.5 bushels per acre. This yield was also 3.5 bushels per acre higher than the projections in the WASDE report released a month earlier. This proved to be another blow to those expecting higher futures corn prices as prices came crashing to their previous lows by mid-September.

With all this drama playing out in the futures market, spot markets were still firm and maintained their strength throughout and trading, at some places, at record basis.

Sudden cut in stocks

The recent quarterly Grains Stocks report, released on 30 Sep 2019 by the NASS of the USDA, somewhat confirmed the belief that it is the spot market that was providing a clearer picture. As per this report, the stocks of corn were, to everyone’s surprise, down by around 300 million bushels. It was startling because the only parameter that could have brought a major change in the stocks was the feed usage, which, in this quarter, had shifted to Kansas wheat. What, then, prompted the sudden reduction in stocks? Were the expectations or the quarterly stocks, released by the USDA, in the prior two quarter so out of line? The answers to these questions are subjective for now we surely know the carry over for next year has declined by 300 million bushels. Farmers, throughout, were not ready to sell corn in the spot market despite spot prices remaining high causing the wide basis (as explainer earlier). Instead, they were waiting for better prices. Perhaps, they had a better idea of the overall stock situation.

What’s next

The WASDE report, released on 10 October 2019 by the USDA, indicated that the yield was better than expectations and even better than the estimates of the WASDE report of September 2019. Amid the continuous escalation in the US-China trade war and the general dovishness of the US Federal Reserve, better yield numbers might force corn prices to stay in a tighter range. Overall, with the remaining data releases for the current crop season, there might be few more surprises in the store. With the information available presently, we expect corn prices to remain in the range of $3.65 – $3.90 per bushel.

Disclaimer

Opinions expressed in this blog belong solely to the individual authors and do not necessarily represent the opinion of Futures First Academy, its management and other group and associated companies. These opinions do not represent professional advice. Any action you take upon the information on this website is strictly at your own risk, and we will not be liable for any losses or damages in connection with the use of our website.