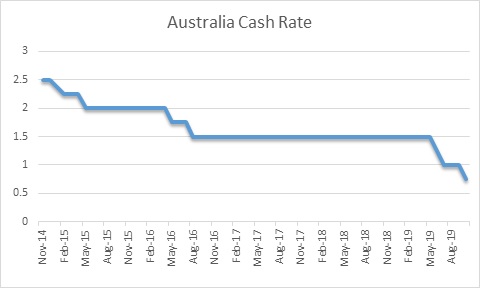

After a long 33 straight months of staying dormant on interest rates, the Reserve Bank of Australia (RBA) started its easing cycle in June this year, with the first of what is now a total of three rate cuts. This was, in part, due to weakening global growth, trade uncertainty and flagging domestic economic conditions. But interest rates are also falling because these days Australian economy shows up more in jobs than in wages. So, inflation seems harder to get reverted anytime soon. That is why, the RBA is accelerating its easing cycle indicating that inflation is more of a worry for the central bank than economic growth.

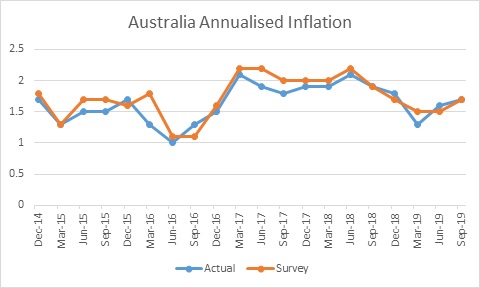

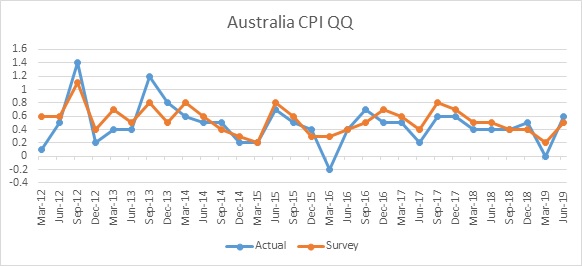

The data for 3rd quarter suggests that Australian inflation has been quite stable since its previous reading in the month of July. Reserve Bank of Australia, till then, had delivered two consecutive cuts of 25 basis points in the official cash rate (OCR) in June and July. The central bank did not deliver a cut in the month of May while the markets had expected 55% chances of a cut. The futures market started anticipating a reduction in the cash rate after the April CPI quarter-over-quarter (QoQ) came in at 0% and year-over-year (YoY) at 1.3%, which was well below both the consensus estimate of 0.2% and the central bank’s estimate of 1.4% p.a. published in its February Statement of Monetary Policy. We had also expected the central bank to act in May as earlier in 2015 & 2016 the then RBA governor had indicated that: –

“Continued low inflation would provide scope for easier policy, should that be appropriate to lend support to demand.”

This was done not once but thrice when the central bank focused on inflation as the main driver for the change in its monetary policy (earlier in 2015 & 2016). Even the US Federal reserve, after delivering a rate cut in the October meeting, has indicated a pause. The Fed Chairman J. Powell, in his press conference, stated that incoming inflation data will be important for the Fed to act upon. Similarly, the RBA Governor Philip Lowe, in his speech, has reiterated that an extended period of low interest rate is expected to bring the inflation back into the target range. Before moving further, let’s first try to understand what this inflation targeting entails.

Inflation Target Regime

The Reserve Bank of Australia defines inflation target as follows: –

“The inflation target is defined as a medium-term average rather than as a single rate (or band of rates) that must be held at all times. This formulation allows for the inevitable uncertainties that are involved in forecasting, and lags in the effects of monetary policy on the economy. Experience in Australia and elsewhere has shown that inflation is difficult to fine-tune within a narrow band. The inflation target is also, necessarily, forward-looking. This approach allows a role for monetary policy in dampening the fluctuations in output over the course of the cycle. When aggregate demand in the economy is weak, for example, inflationary pressures are likely to be diminishing and monetary policy can be eased, which will give a short-term stimulus to economic activity.”

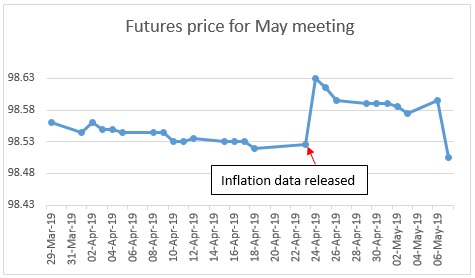

Since November 2018, the RBA has been revising down its inflation forecast in its Statement of Monetary Policy (SOMP) and actual readings have been coming in well below the forecast. In the November 2018 SOMP, RBA forecasted a 2% inflation rate for December 2018 but the actual release came in at 1.8%. Next, in February 2019, RBA forecasted 1.4% inflation, which they had earlier estimated to be 2% in June 2018, and the actual inflation came in at 1.3%. 2 consecutive readings below the central bank’s forecast made the market anticipate a rate cut in the May 2019 policy meeting. The graph below indicates how the pricing changed, in the interest rate futures market, right after the release of the April inflation data. Price at 98.63 indicates a 41% probability of a rate cut as the rate decision was on 7th of May and accordingly the settlement price, if a rate cut was delivered, would have been 98.696.

After this brief understanding of the inflation target, let’s try to understand what the Ideal scenario might be to achieve such target.

How deep can the rates go to meet the inflation target?

The RBA’s model of the economy suggests it will fall well short of achieving its 2-3 per cent inflation mandate even if it positions the official cash rate (OCR) at 0.5 per cent for the next few years. After cutting its monetary policy rate to a record low of 0.75 per cent on 1st October 2019, the central bank is widely expected to reach 0.5 per cent by February 2020; but there is a “substantial risk” that it will deliver even deeper interest rate cuts and be compelled to implement unconventional policies like quantitative easing. If RBA has to meet its inflation target, it would not be wrong to see the official cash rate (OCR) into the negative territory. The RBA Governor, in his recent comment also said: –

“Negative rates are unlikely but possible.”

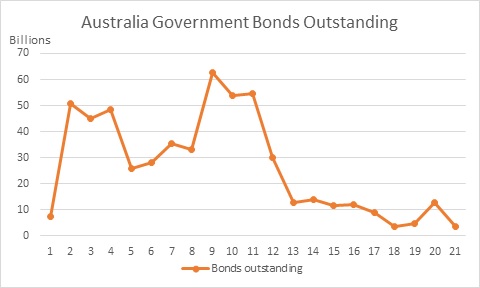

A recent survey model estimated cash rate needs to be -1.00% to meet the inflation target. The equivalent of the -1.00% cash rate would be to take the base rate at 0.25% and implement a QE program of around $200 billion. The following graph shows the total debt outstanding in the time period relevant for such potential QE program. Most of the outstanding debt lies within 2-3-year maturity and 8-10-year maturity from today.

At this point, we must try to understand how historically the official cash rate has moved and how the Central Bank has reacted in order to bring the inflation back into its target range.

Historical CPI releases

Back in 2016, when RBA reduced the benchmark rate to 1.5% by the end of that year, RBA’s major concern was inflation slipping into the negative territory for the first time in more than a decade. To bring the inflation close to the target range, the then Governor of the RBA, Glenn Stevens, had already reduced the Official Cash Rate (OCR) by 25 bps in Feb 2015 and May 2015. Then he followed up cutting rates twice by the same magnitude first in May 2016 and later in August 2016. In May 2016, markets had not anticipated a reduction in OCR even a week before the rate decision. The market theme changed right after the inflation came in below the market expectations. The market expectation was for +0.3% and the actual data came in at -0.2%. The graph below shows the actual inflation data and the market expectations for the corresponding releases. RBA has reiterated the following comment again and again to signify how important Inflation figure is for the Central bank to make policy decision: –

“The Board will continue to monitor developments in the labour market closely and adjust monetary policy if needed to support sustainable growth in the economy and the achievement of the inflation target over time.”

Historically, the central bank has given a strong weight to the CPI data while making their official cash rate decision. Various components of the CPI are as follows: –

1. Alcoholic Beverages, tobacco and Narcotics

2. Health

3. Education

4. Households and NPISH

5. Finance and insurance

6. Food and Nonalcoholic Beverages

7. Transport

8. Recreation and culture

9. Furnishing and Household Equipment

10. Clothing and footwear

11. Communication

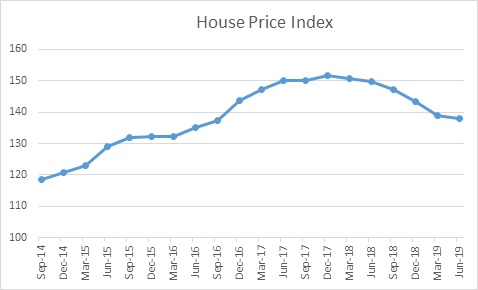

The housing component in the CPI is the most important component in the current economic framework. Overall, house price index for 8 capital cities in Australia started falling since the beginning of 2018. This falling house price is explained by weaker consumer sentiment and lower demand for the consumption of housing in the domestic market. Towards the mid of 2018, China realized major housing investment of their overall portfolio in various economies which resulted in an extra supply of housing in the economy. The RBA, in late 2017, had communicated that stable/rising house prices is an important factor for the Australian economy to sustain the expansion. This, clearly, has not been happening for almost a year and a half and has contributed to a sustained fall in the CPI.

Our outlook on the economy

The RBA recently kept its cash rates on hold in its November meeting and a case for December meeting can be made only after the release of the November labour data. As for the central bank, both labour and inflation have been the focus area in their recent comments.

The 3 rate cuts this year, a tax relief, a somewhat visible rebound in the housing market and a pickup in consumer sentiment should help the Australian economy to rebound by 2nd half of 2020, and the inflation to pick up by December 2020. But the inflation does not seem to tick up in near future and in recent SOMP forecasts, RBA has downgraded its growth forecast for 2019. We expect RBA to go for at least one more 25 basis point rate cut by February 2020. But we should not rule out the case for a reduction in December 2019. We also expect RBA to communicate about the unconventional policy measures when they reduce the cash rate to 0.5%, and not before.

Disclaimer

Opinions expressed in this blog belong solely to the individual authors and do not necessarily represent the opinion of Futures First Academy, its management and other group and associated companies. These opinions do not represent professional advice. Any action you take upon the information on this website is strictly at your own risk, and we will not be liable for any losses or damages in connection with the use of our website.